※Key summary

1) Currently, operating profit is maintaining a slight loss level. Until large-scale commercial mass-production begins, sales are unlikely to see much.

2) At the end of the Proof of Concept process for Tier 1 AR/VR customers. Large high-end dPd deposition equipment for mass production was received in September 2022. It is expected to undergo verification work (qualified test) around July-August 2023.

3) There are a total of 4 customers who are talking about AR/VR mass production.

4) The ENVG-B (U.S. Army Night Binoculars) project is a surprising product. The company's related sales should range from at least W100bn to a maximum of W400bn.

5) Currently, eMagin is the only company that can produce MicroOLED Display with 10,000cd/m2 brightness and 4K resolution. Even the company can do it with 1Stack (due to its direct deposition technology).

eMagin Corporation (EMAN) CEO Andrew Sculley on Q2 2022 Results - Earnings Call Transcript

eMagin Corporation (NYSE:NYSE:EMAN) Q2 2022 Earnings Conference Call August 11, 2022 09:00 AM ET Company Participants Mark Koch - Chief Financial Officer Andrew Sculley - Chief Executive...

seekingalpha.com

Revenue/Gross Profit/Operating Income/Net Income (All numbers in thousands)

2Q22 7,159/1,569/-1,792/-1,440

1Q22 7,358/2,489/-1,165/-137

4Q21 7,212/1,755/-1,784/1,144

3Q21 5,782/559/-3,313/1,306

2Q21 6,279/571/-2,907/-278

2021 26,046/4,593/-9,962/-5,206

2020 29,424/6,365/-6,917/-11,448

2019 26,726/6,728/-5,571/-4,298

2018 26,235/3,994/-11,667/-9,542

Q2 2022 Earnings Conference Call.

Company Participants

Mark Koch - Chief Financial Officer

Andrew Sculley - Chief Executive Officer

Conference Call Participants

Kevin Dede - H.C. Wainwright

The improved yields and increased throughput resulted from the impact of the new government-funded equipment in our production facility and improvements in our manufacturing operations.

We achieved continued growth in display revenue from the ENVG-B program and other military programs, along with increased veterinary and surgical revenues

We also strengthened our relationship with a major prime contractor by advancing our capabilities for higher level assembly and shipped displays to a customer providing heads-up displays for optical surgery.

As of the end of the second quarter, our total backlog of open orders remained strong at $14.3 million with $12.8 million shippable over the next 12 months. This reflects demand for our displays for use in thermal weapon sites, military night vision goggles, and medical applications.

Additionally the US Army's program office -- Program Executive Office for Simulation Training and Instrumentation awarded us a $2.5 million two-year development contract in Q2. Their goal is to secure a US source for high-performance microdisplay that provides high brightness and visual acuity even in bright daylight conditions.

We will design a backplane that will allow for significantly higher luminance of our dPd displays and ultimately leverage the full potential of the equipment we are acquiring under our Title III and IBAS funding grants.

Furthermore, we anticipate that our government-funded dPd tool will be available to satisfy this demand for high luminance displays as well as demand from both existing and new military customers.

At the same time we are continuing our proof-of-concept display work for a Tier 1 AR/VR customer and are anticipating the September arrival of an advanced dPd chamber for R&D usage which will, we will use to complete the remaining OLED deposition phase of this contract.

※Tier 1 AR/VR customer is estimated to be Apple. Apple is expected to release 1st gen VR devices in 2023, 1st gen AR devices in 2024, and 2st gen VR devices in 2025. The timing seems tight for the company to supply the 1st gen VR device to be released in 2023. It seems to be able to be mounted on AR devices or 2nd gen VR devices.

The proof-of-concept work is currently in progress, and the part that said that the remaining deposition process will be possible when the advanced dPd chamber arrives in September is a part of the current progress.

This new R&D chamber will enable us to fabricate additional high brightness prototypes. Moreover, it should accelerate progress with our product road map as we await qualification of a government-funded dPd tool, early in the second half of 2023. That will be capable of serving our military and commercial markets.

As previously announced in May, we received the People's Choice Award for Best New Display Technology, at Display Week 2022 where we showcased our direct pattern, single-stack color, OLED microdisplay which is capable of over 10,000 candela per square meter of maximum luminance.

※ It is mentioned that it has the highest level of technology with a brightness of 10,000 cd/m2 in 1 stack.

Lastly, we have completed a preliminary audit and expect to obtain an AS9100/ISO 9001 certification in the third quarter of this year.

Question-and-Answer Session

Q1.Just help me understand the time line and maybe a little bit more on the new Army development contract. I understand that you need that deposition tool to come in I guess next month. How long will it take for you to get that thing in place and online operating properly in order to perform what the Army is asking you to do?

A1.Well there's a couple of things to think about. One is the tool comes in. This is an upgraded R&D tool and that comes in in September. And then we – it's just an upgrade of the old R&D tool, with some good very good upgrades. It will take some time to get up. But the other thing to realize is the US Army program for $2.5 million that that requires a backplane redesign and we're doing that. And so that backplane design will take us through the end of the year and then the R&D tool will be up and running. And that's a two-year program.

And the other thing is we don't expect the R&D tool to take an enormous amount of time and it's important because the Tier 1 project we're working on, we need to do additional OLED deposition and we want to use that new tool, so that should start shortly after September.

The other important thing we said this during the prepared remarks the other important thing is the new Title III tool will be able to produce this very high brightness color display in volume. And I'm talking about our volume type. So that's going to be an extremely positive.

Q2. It seems there's a total of seven tools that are part of the upgrade process. Three you have and four are coming. Do I understand that correctly? And then I think there's one big deposition tool. Is that the one that you're referring to?

A2. Yes. And that's, correct. You're counting well. And the large deposition tool, is the one that will be able to do our direct patterning or dPd, in production and that's mass production for us. It will also be able to do ---any display we make today, could be done on that tool. And it will also be able to do this very high brightness, with the new project by the Army.

Q3. Okay. would you mind just sort of taking me through the timeline on that? I understand that's supposed to be in by the end of the year, but it could take a while to get it dialed in. We shouldn't really expect it to be up and running, until maybe the third quarter next year?

A3. What we said, yes, the big tool. We said that it would be in, and then we would qualify it in the second half, early second half of next year. And therefore, we'll be able to run things on it. Of course, it will take some time to qualify all our products on it, if we want to do dPd on every one of our products today.

Q4.Okay. Now my understanding is that you're going to run what you currently have in parallel, right? So that will give you a little more redundancy?

A4.Yes. Yes the current larger tool and this current large tool, is small compared to the new one, but the current large tool will be continuing to run and we'll be able to run both tools in parallel. And that's one of the ideas, is that the single-use failure, now will have two very good tools. One capable of course in mass production of the direct pattern displays, and also the new display that we're designing for very high brightness, full-color mass production. And here, what I mean by very high brightness, we already got over 10,000 candela per meter squared. And now this next effort will -- we can estimate that it's going to be 1.8 times to 2 times what that is.

Q5. Is that going to be a dual stack configuration, or will you be able to do that just in a single?

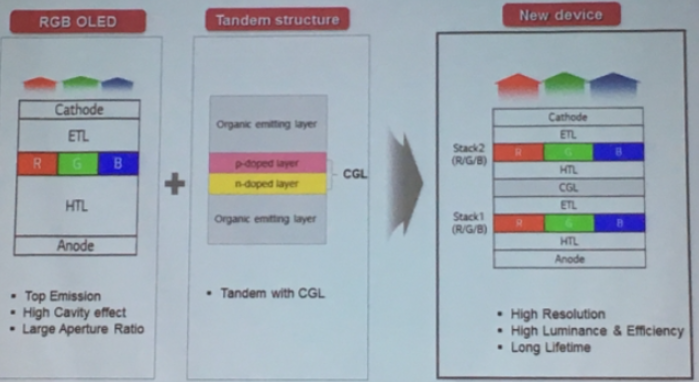

A5.Well the dual stack or tandem architecture is one of the things that we're working on as well. Sure. And by the way doing a tandem architecture on a - and that's the common language from the inventors, but the tandem architecture is much easier to do with red, green and blue singly, than a tandem white, so we have an advantage over everyone. And the other great thing is, when you do a tandem architecture, we don't have the color filters, which throw away 80% of the light, so a very big advantage here. And as you know, you've heard things like a tandem architecture, where I actually heard a three stack, at the Display Week 2022. One company had maximum of 7,000 nits although from my eyes they were only running it at 2,000. 7,000 nits, white with color filter three-stack tandem. And here we've got one stack, with direct patterning at over 10,000. And when we do this next program, it's going to go to more something like 20,000. What an advantage we have.

※What this means is that most display makers are using RGB as a color filter with White as the light source. This is because RGB cannot be directly deposited. In order to overcome the short lifespan, which is a weakness of OLED, OLED, which is applied to IT devices with a long service life, such as tablets and laptops, is being developed in a two-tandem structure. Since the company directly deposits RGB, it is advantageous in terms of brightness, lifespan, and resolution, as well as a two-tandem structure. It seems difficult for companies that use white light source + RGB color filter to fight at the next level.

Q6.Yes. Thank you, Andrew for that extra color. Could you just walk us through where you are on the consumer development side? Obviously, you spoke to one program, but my understanding is there are others and lots of development that you've done in the past. And I'm just hoping, you could speak to where your current programs are and how much interest you're seeing.

A6.Well, everyone we talk to, and this is on the AR side or VR side, they don't always tell us what they want. They want a very high resolution so 4,000 is the key number nowadays. The newer ones, didn't want to stitch the backplane -- sorry for the technical jargon, but if you don't stitch the backplane, you have to have something with smaller diagonal. If it's a square, diagonal has to be something like 1.3 inches, instead of the 4,000 resolution, we did was 2.1 inches in diagonal.People want it smaller nowadays. And we have spoken with a number of companies. We gave them the path forward, on how to get to a 1.3-inch diagonal near as 4,000 as we can get and there's great excitement. The other thing is I have to say that, no one has told us they can withstand less than 10,000 nits. So even those three-stack white that we saw at Display Week 2022 that's not good enough.

And you asked about the past. So the other thing, this new R&D system that's coming in, in September, we need to finish the prototypes for the Tier 1 we're working with now, all of the prototypes with the OLED.

And then, the next step is, we want to also produce more of those 4,000 resolution displays that we already have. And we've shown the 4,000 display to a number of companies and the company who paid us to design that allows that to happen. We don't violate anything, of course. And then, that creates excitement too.

Q7.Okay. Just want to switch gears a little bit. Mark, it looks like the gross margin was down sequentially. Do I have those numbers correct? And on flattish revenues, could you just help me understand why that happened?

A7. It was a slightly lower manufacturing volume in WIP to absorb the cost out, say, 15% lower volume. And in the first quarter, we had some recoveries of displays that we had taken a look at the specs and discovered that we were being too tough on ourselves. It does include some recoveries of displays that we were able to reclaim and put into our inventory, which was a positive adjustment. So we did not have that reoccur in the second quarter.

Q8.could you refresh my memory on the accounting or synopsis of actually accounting and the deferred income on the government award, because I keep seeing that increase as a liability?

A8.Yes, certainly. When we -- like we make progress payments to vendors for the equipment. And as we -- in advance of the progress payment being due, we bill the government. The government pays us the funds for it to reimburse the government, so we increased our fixed assets. Then we also increased the deferred revenue liability.

And then there's another step that you're starting to see in our other income section. You see, there's other income of $350,000 in Q2. So as we depreciate this equipment, the depreciation, for the equipment for the new government equipment shows in COGS. But the accounting says, as we depreciate it, we actually recognize the benefit or the income from the government grant.

So, over the course of the program, all of that deferred revenue will eventually be amortized to other income. All that will decline over the course of the program, commensurate with the amount of depreciation expense each quarter.

Rather involved, but I guess, if you pull back on the macro level, we've received these over $35 million $39 million in funds from the government and the accounting on a macro level is that, it's a grant. It's considered an income in that sense. And we recognize that income over the useful life of the equipment, which, of course, is basically a proxy for the depreciable life of the equipment.

Q9. Just walk me through where you are in government projects. Understand the new development one and the EMVG, but I know that there were a bunch of other things helicopter, helmets, missile targeting, displays. What else can you help me with?

A9. Just there are a number of projects that we're already on and working on like the helicopter. And forgive me we can't name who is the actual customer. There's a number that we're also working on. And I'll just mention that, for example, the family of weapon sights there was another bid that had taken place and we used our displays with a number of primes. And one of them is -- looks like it's going to get the award. So that's one.

We are on a significant aircraft, and we're still supplying displays to an aircraft helmet. Sorry, I can't mention the name, but that's very good for us. And some of the other programs that we're on they are not in the US. We are providing displays outside the US as well. And there is one of them that is a tank program where the people in the tank can put on a device and they don't have to stick their head outside and it looks outside of the tank. And they can also see as an AR device inside the tank also. So it's very interesting to us.

Okay, one other one obviously we have a longstanding customer which is a big customer that is for consumer thermal scopes for hunting. And you might think that that's a small volume, but for us it's very big. And they also now work on the government side. We have a number of programs going very well.

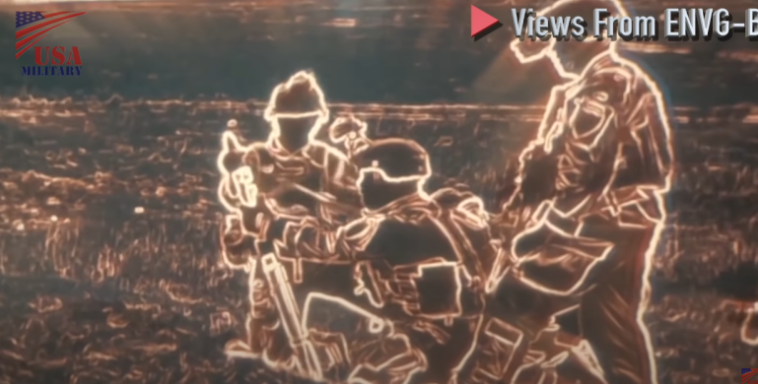

ENVG-B they recently got a big plus up in terms of government funding. Instead of $75 million they went up to so it's not going to necessarily reach the number of $300 million for government funding. It's up to $300 million, but we expect it to be much larger than the $75 million. And also if you read the press on this look it up in the Internet it performs very well. So that's other good news. And that's our biggest program right now.

If you look at the video, the night performance is amazingly better than you think.

The U.S. military does not have to aim the gun directly into the eye, but software synthesizes what the gun is aimed at and what it sees through the night vision goggles. Too easy to shoot!!

No, it is revolutionary to see it brightly like a Van Gogh painting at night.

Q10. To my knowledge eMagin is still the only company right now that can do a 4k OLED microdisplay at over 10000 nits. What I wanted to ask and I've asked about this before just kind of your view of kind of the competitive landscape. As we're kind of coming down the home stretch here getting close to the consumers' consumer headset the next generation I think there's some big guys, kind of, going after those same sorts of targets. I wanted to just kind of check in with you and see if you think that changes much over the next couple of years? Where maybe one of these guys kind of gets there and says hey we can do that too, or do you feel like you've got to -- yeah.

A10.Yes. We have good patent protection and knowhow. That said, one of our goals is potentially to get a mass production partner. We're also interested in the CHIPS Act. But a mass production partner and there are a few companies with whom we're speaking about this technology.

There is interest. And I think, the easiest way to get to 10,000 nits is to use direct patterning and our methodology is very good.

Q11. Okay. And I know that you've been thinking about this manufacturing agreement for quite a number of years now. You don't have anything finalized yet, but I just wondered if you've kind of settled in your mind on which company that you're going with, or do you think that it would more roughly be more than one license that you would provide for maybe a couple different companies to use rather than an exclusive agreement?

A11.No, it really depends on the end result. An exclusive agreement is more value -- has a higher price tag than a nonexclusive agreement, so that depends on that. And we are talking to a few, which actually is like four companies about this.

Q12.Okay. All right. And I wanted to ask, there's a consumer company that holds a license to use your technology going back to 2017. Do you still hear to hear from them at all? Are they also interested in you finding a manufacturing partner and maybe willing to kind of help with that process? Do you think that what you're going to do here in September with the R&D chamber, is that kind of the last step to complete the proof of concept?

A12.Yes, we do. They're very interested in this new equipment that's coming in. Absolutely. Yes. We are very happy with the progress that we are making. And the new R&D chamber will be quite good at making the displays. And not mass production. Yes. It's needed to

♬The above article was also published on https://t.me/timesight.

'Investing Ideas > eMagin' 카테고리의 다른 글

| Analysis of MicroOLED Supply Chain mounted on Apple AR/VR - eMagin is the key among eMagin/TSMC/SONY (0) | 2022.07.26 |

|---|